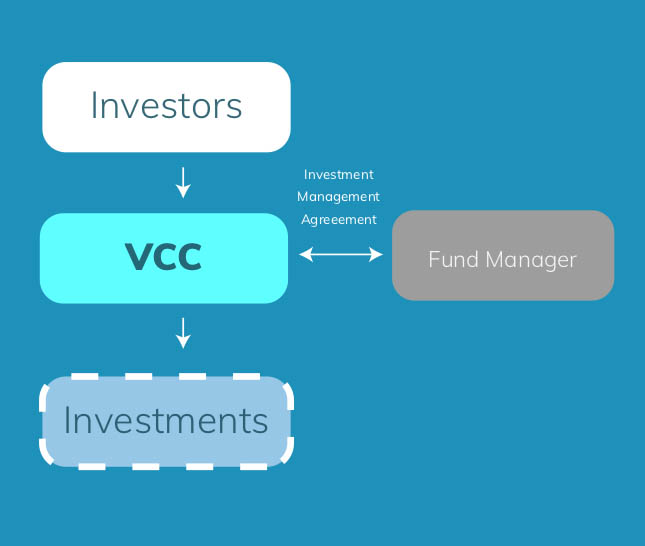

What is VCC?

It is a new legal entity form/structure for investment funds administered by ACRA with AML obligations of VCC under MAS guidelines

What can it be used for ?

Traditional and alternative fund strategies (both open-ended and close-ended)

How can it be set up ?

As a stand-alone or as an umbrella entity with multiple sub-funds

Can a foreign fund be re-domiciled ?

Foreign corporate entities can re-domiciled to Singapore as VCCs

What do you need ?

- Local registered filing agent Corporate secretary

- Singapore based fund administrator

( If 13R or 13X application is considered )

- VCC must be managed by Fund Manager regulated by MAS

What are the benefits?

- Enhanced safeguard by segregation of assets and liabilities in each sub-fund

- Financial statements are not required to be made public

- VCC registar members private but need to be provided upon request to certain persons such as public authorities, VCC manager and custodian

- Improved operational and tax efficiency

- Greater flexibility in issuance and redeeming shares, payment of dividends out of capital

Requirements of a VCC?

- The capital of a VCC will always be equal to its net assets, thereby providing flexibility in the distribution and reduction of capital

- All VCC must be managed by a Permissable Fund Manager. It will require a Singapore-based licensed or regulated fund manager (unless exempted under the regulation*)

- Existing Securities and Futures Act (SFA) requirements for investment funds will apply to VCCs

- It must have at least one Singapore resident director and at least one director (may be the same as resident director) who is either a director or qualified rep of the VCC fund manager. For non-autorised scheme and at least 3 directors for authorised scheme

- A VCC must have its registered office in Singapore and must appoint a Singapore-based company secretary. A VCC must have at least one shareholder

- It must be subject to audit by a Singapore-based auditor and must present its financial statements as per IFRS, Singapore FRS, US GAAP, or RAP 7

* Currently, fund managers exempt from regulations – real estate, single family offices, and related party exemption – cannot use VCC. This list may be intended to expand in future.

VCC – Fund Structure and Tax Treatment

Stand-alone (Single fund) VCC

The tax treatment of a stand-alone VCC will remain the same as that of a Singapore company

The Enhanced Tier Fund (”ETF”) Scheme(13X) and Singapore Resident Fund (”SRF’)(13R) Scheme under the Income Tax Act will apply to a stand-alone VCC similar to a Singapore company as accordingly

Umbrella (Multiple Sub Fund) VCC

( Commonly referred to as an Umbrella VCC )

Summary of key features and conditions of tax incentives schemes in Singapore for funds

Other Tax Related Key Elements

GST

The current GST remission will be made available to VCCs approved under the ETF and SRF schemes.

Certificate of Residence (“COR”)

A Singapore COR is available for the VCC subject to the VCC establishing that it is controlled and managed from Singapore.

In the case of an umbrella VCC, the COR will be issued on the VCC master umbrella level, with the names of the sub-funds receiving the same nature of income from the same treaty country included in the COR

Withholding tax exemption

The current withholding tax exemption available to funds approved under the ETF and SRF schemes will be available to VCCs approved under the ETF and SRF schemes.

Incentive scheme for fund managers

The 10% concessionary tax rate under the Financial Sector Incentive – Fund Management Scheme will be extended to approved fund managers managing incentivised VCCs.

Investment Objective Condition

One of the current conditions of the ETF and SRF scheme is that once the funds has been approved under either schemes, the funds will not be permitted to change unless permitted or approved by authorities. This is applicable to all sub funds.

Addition of new sub funds

There is no need to seek approval from or inform the authorities if there are new sub-funds added to a VCC. However, where the investment scope has changed with the addition of a new sub-fund, an approval will be needed from the authorities to expand the investment scope. Further, if there is an announcement of termination of the ETF and SRF schemes, then additions of sub-funds will not be allowed.

For more information or a PDF Version of this post feel free to drop me a note on linkedin.